With coronavirus pretty much being heard everywhere, understanding and knowing the facts are important.

Category Archives: Random Thoughts

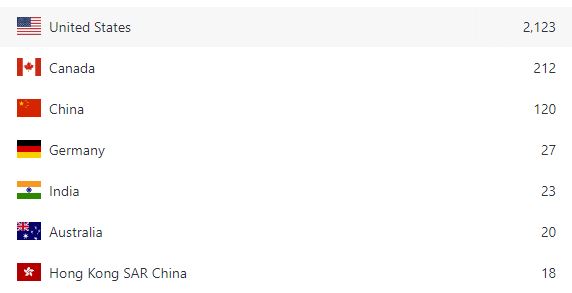

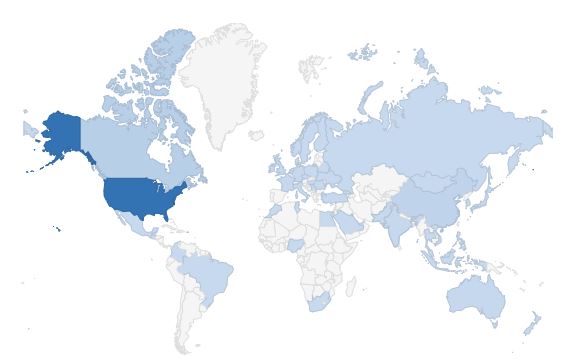

WP Statistics…

When I log into WordPress, the default page I see is the statistics page… Logging in today, I see this map of China. And it got me thinking if any of my posts are being censored. There would be no way for me to know is there…

But I also started to wonder what the breakdown of total visits since this website was started on WordPress.

Now that’s interesting… Hong Kong is its own little entry. The “renegade” province of Taiwan isn’t represented. Based on the map of countries that WP has below, it seems like people are clicking from around the world. That’s pretty cool.

Nerdy Financial Speak

I was looking at my 401K this morning and had a thought…. “How much money has an individual contributed to a 401K if they started in 2000 and they contributed the max allowable every year?”

Fortunately, a search yielded this website. Plugging the numbers into Excel was pretty easy. Total contribution for the past 20 years (starting in 2000) amounted to only $329,000. And so I had another thought… “Websites lately have been saying if you are XX years old, you should have YY amount in 401K.” I went back to search a few websites and although they didn’t tell me much. One website stated that by 30 I should have 1x my salary; by 40 I should 3x; by 50 I should have 5x. As the website stated above, I wondered if it was possible that someone working 10 years making 50K could actually have 1x salary saved. Remembering back how I first started working, money was tight. Looking at the numbers, it’s possible but the numbers are difficult to “hit” 40 and 50 strictly looking at the just contributions alone.

The first website I linked also had a target guide. The guide lists # of years worked and then a range on Low/Mid/High. According to the website, if you’re between 30-45 (Middle Age/Mid End) you should have somewhere in between $150,000 to $500,000!? Fact: If you contributed the max amount for 20 years starting in 2000. You would have only contributed $329,000. $329,000 is smack dab in the middle. If you’ve been working for only 10 years, you just hit a max range between $140,000-$180,000. And… My guess is total contributions would be lower since generally the first 5-10 years of working… money is tight resulting in less than max contributions. I know I probably didn’t max my initial working years. And for awhile, I didn’t have income while in graduate school too.

Now… to throw a wrinkle into these numbers, 401Ks grow over time. It’s been known that “beating the stock market” is not a long term viable strategy. Hedge funds and actively managed funds do not consistently perform as well as the index funds. Buffet won a bet using this strategy of passive investing with low maintenance fees. Now based on this website, some growth calculation is needed via Excel. Some numbers to think about… Mutual funds over the past 20 years have a 4.6% return. In the past 10 years, have a 4.2% return. In the past 5 years, have a 6.9% return. Stock index’s like S&P 500 have performed with a 10% return in the past 5 years. For someone who started working in 2000 and contributed the max for 20 years, that person would have just a little over $510,000.

What’s even more interesting is if the calculations assumed a 10% return based on 90-yr historical stock performance, you’d only be a sliver over $905,000. But there’s so much more volatility with stock performance that ultimately depends on “timing the market.” If specifically looking at S&P 500 funds (60-yr history), that return has been about 8% or $727,000 and also depends on timing the market.

In summary, for the past 20 years, an individual who has been diligently contributing to the max allowable 401K amount would result in either:

- $510K (5% mutual fund)

- $727K (8% average stock index fund)

- $905K (10% historical stock market performance).

If your current 401K portfolio falls anywhere in that range (or higher), I think you’re in good shape. The numbers I presented are what I believe baseline minimum numbers of what an individual should currently have in their 401Ks based on 2 key assumptions: a 5% mutual fund growth and max contributions since 2000. So even if you didn’t make max contributions every year, if your portfolio value is between these numbers than consider yourself “caught up” to the minimum. Give yourself a reward because YOUR MONEY WILL ONLY GROW from here on out

Super Bowl Breakdown

Egads… what a colossal defensive SF breakdown in the 4th. I watched the last 10 minutes of the 4th quarter where San Francisco was up 20-10. Biggest lesson? Penalties Sink Teams

The big 44 yard catch by KC’s Hill on a 3rd and 15 and the subsequent SF pass interference penalty shifted the momentum towards KC. From there on out, it was a touchdown to bring it to 20-17. Then an SF… 3 and out. Where’s that run game!?

With KC in good field position, Sherman let his guy slip past him for another big gain which soon led to another TD and KC on top 24-20. The following drive to “win” the game ended up in a turnover on downs. And after that… KC runs it in for another TD to seal the game.

Looking at the highlights on YouTube, penalties sink teams. The penalty at the end of 1st half hurt the 49ers. They had a chance to score going into halftime but that penalty pretty much guaranteed a tie game. Then that critical pass interference pretty much sparked KC’s momentum and subsequently demoralized the SF defense with 2 quick scores. Looking at how SF defense started playing after this penalty, I had a feeling that they were going to lose.

The Money Way of KonMari…

Japanese exports not just anime…. but mindfulness techniques. First there was the KonMari method which is a mindfulness exercise on how to manage clutter. Today, I readabout the Kakeibo method which is also a mindfulness exercise on how to manage finances.

One of the KonMari tenets is to decide whether or not an item “sparks joy.” Reading about Kakeibo, there are 4 questions to answer…

- How much money do you have available?

- How much do you want to save?

- How much money are you spending?

- How can you improve?

This kind of makes me wonder… can the mindfulness to eating also be connected like with the KonMari and Kakeibo methods? Maybe these 4 questions?

- Am I hungry?

- Am I eating because food is in front of me?

- Am I eating because it’s the “appropriate time” to eat aka breakfast/lunch/dinner?

- Is what I am eating going to make me happy?

Or maybe simplified to just the first, third and last question?

“Cha” or “Tay”?

This link blows my mind. It never occurred to me that two different words for “tea” originated based on how it was exported.

Suits

I have to say… Wearing a suit really makes a difference. But only on relatively normal figured guys (aka no belly, no fat butt).

=/

OMG… the Customer Service…

Since it’s the end of the year, there are quite a few online sales that go on. In addition, my credit card also have deals if I spend $X at a particular location, I get $Y back. In this case, I had to spend $150 to get $30 back. That is an effective cash rebate of 20%. And so it happens, I needed some shoes and a fairly popular shoe brand had a sale. I ended up ordering two pairs of shoes to be able to satisfy the spending requirements. Each pair was shipped separately but to the same location (a UPS store).

A few days go by and I get a notification that both shoes have been delivered. However, it turns out, only 1 of the shoe was delivered. The remaining shoe was still in transit. I waited two more days and it became apparent that 2nd pair would not be arriving. I started to investigate the whereabouts of this 2nd pair by calling UPS. This is where the fun begins…

UPS customer service rep (CSR) tells me that the package was apparently delivered to the wrong address. Furthermore, the CSR says to start initiating a claim through the UPS.com website. Ok fair enough. I go to the CSR Portal and input the tracking number. And I get an error saying that the tracking number cannot be used to file a claim. WTF!? So I called UPS back again and they kept transferring me for no real good reason as I was trying to explain the situation. Eventually, I got to a person who investigated and said that the shoe brand placed a restriction on the tracking number to prevent customers from making any sort of claim. My only recourse was to contact the shoe brand and not UPS. Seriously? (╯°□°)╯︵ ┻━┻

And so I called the shoe brand. After explaining the first part of my situation, the customer service rep responded with some sass responding with “why doesn’t the UPS just go back and pick up the package?” and “just log into UPS.com and go file a claim and get me that claim#.” But after hearing that there’s some sort of hold preventing me from filing a claim, the rep’s sass disappeared and put me on hold. I guess after consultation with while on hold, I received a fraud#. The rep opened a fraud claim to have the fraud department investigate.

Ya I don’t know… ¯\_(ツ)_/¯

Plant Based Diet?

This Netflix documentary “The Game Changers” makes a very compelling case why switching to a vegetarian diet is good for general health, sports performance and recovery, and even the environment.

The evidence presented throughout the documentary makes a compelling case as to why a plant based diet is significantly better. Some of the people promoting the rationale as to why plant diet is better include…

- Blood test of subjects that ate meat one meal, then plant based the following day.

- Firefighters on a 1 week program with average cholesterol drop by 20 and average weight loss of 6 pounds.

- Weightlifters (Schwarzenegger), football players (select players from Titans), Olympians (a American track cyclist, Australia sprinter)

- Doctors and specialists who talk about the evidence (of course!)

I have to admit… what the documentary is saying is pretty convincing. But what about a diet full of fruits and plants compared to just plants only?

The Morey Tweet

I wonder what the general American populace thinks about the NBA after it initially censored the “Morey Tweet.” Is this a case of where a company lost sight of what it’s values are?

Should you be worried that a foreign government has that much influence on a company?

Should the American government be worried?